1+1>2: How to create value after broadcast vendor M&As

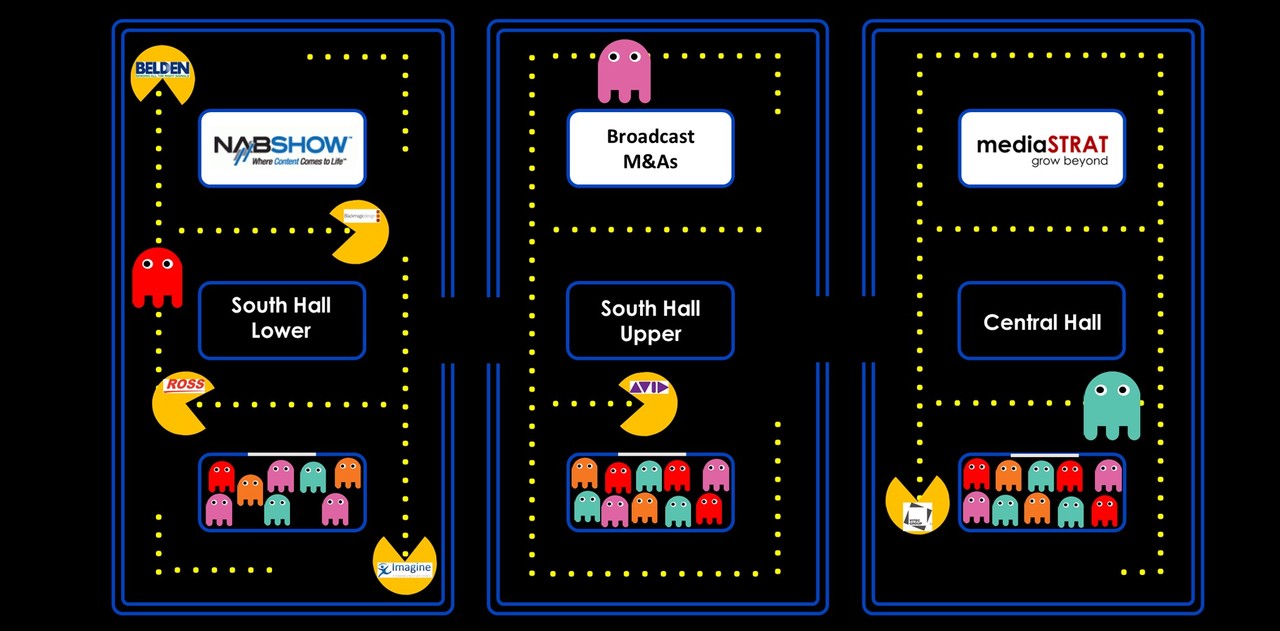

The NAB show period is favourable for merger announcements and rumours. This year is no different with the confirmation of Belden / Grass Valley acquiring S.A.M. Recent analysis from MediaBridge Capital Analyis and Devoncroft track the rational and the dollars behind M&A’s.

Have the M&As produced the anticipated value for the companies and its customers?

When digging in my memory dozens of vendor names from the past like Leitch, Pinnacle, Abekas, Scopus, Omneon, Louth, Pluto, Front Porch or Canopus come to my mind. Some of the products developed by these companies have become an essential part of the portfolio of the acquiring company but many more have vanished.

In a maturing and transforming market the M&A drivers like faster access to technology, competitive consolidation and increased solution portfolio to drive sales team efficiencies are all pertinent. But for a few notable exceptions looking at the evolution of post-merger revenues a few years later seems to demonstrate that a very significant portion (not to say most) of the announced value creation has actually not materialized.

Where has the value gone?

Back in September 2016 I already touched upon the topic in my blog “M&A Wisdom: Don’t buy what you can’t sell”. It did focus on the got to market problematic and the difficulty for sales teams to deal with products that might be complementary in the production workflow but quite different in their nature and go to market paths. Go to market is only one of the many operational post-merger challenges alongside product development roadmaps alignment, legacy system support, branding…

The integration of ERPs, CRMs and staff functions is the starting point of the integration process. Within product management and sales even years after the merger one almost instantly identifies with which of the former vendor one is interacting with.

Investing in integration is key

The integration challenges exist is every industry, but the resulting value destruction seems more prevalent looking at broadcast media vendor mergers.

Investing more in post-merger integration to execute on a unified strategy built on a shared vision and an aligned go to market strategy seem like trivial advices but should be the rule not the exception.