Different go to market strategies

There are multiple ways to organise an international sales force: By region, by product line, by go to market strategies (direct versus indirect or OEM), separating hunters & farmers, by nature of the customers/type of usage… They drive the efficiency, localisation, reactivity and economies of scale of sales teams. All these models have pros and cons and vendors tend to navigate between them over time. The centre of gravity of the sales organisation also varies depending on where does one set the cursor between centralise whenever possible and localise whenever necessary versus highly decentralised approaches.

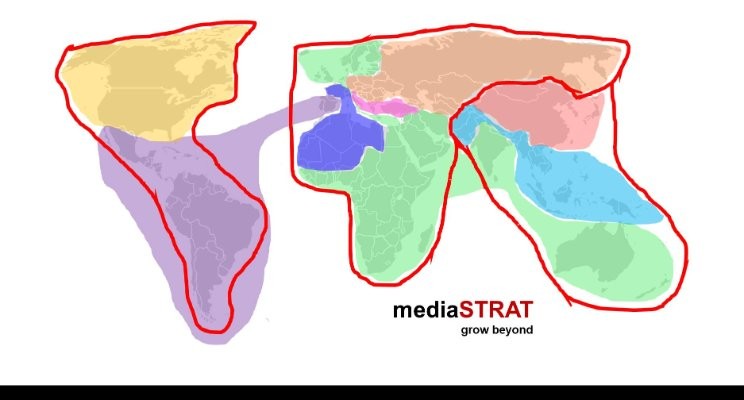

…across different regional organisations

The footprint of each region varies significantly depending on the history, the culture, the focus, the business volume… of each company. Alongside the classical NALA (North and Latin America), APAC (Asia Pacific), EMEA (Europe, Middle East & Africa) many more regional organisation models with corresponding acronyms coexist: EROW (Europe & Rest of the World); MENA /Middle East & North Africa), CEE (Central & Eastern Europe)… In most cases this means that the vendor and prospect regional and international organisations most rarely match.

… end up being a business challenge

Successful engagement with key account customers is itself a difficult endeavour. Vendors have to navigate between multiple departments and stakeholders with different motivations: technical, operations, procurement, legal. It is often combined with complex tendering and sourcing processes. When adding the multinational layer it becomes a major challenge.

Even if the key account generates enough revenue to justify a dedicated sales team the friction with different regions each carrying their own sales quotas is important. It gets even worth when the go to market strategy combines direct and indirect models (for example through VARs, System integrators, OEMs or agents) in different regions. Most CRM and ERP systems struggle to cope with accounts sitting across multiple regions. Simple tasks like extracting cumulated revenue or looking at a combined pipeline require significant efforts and often end up on excel sheets.

Why would a vendor want to chase such accounts?

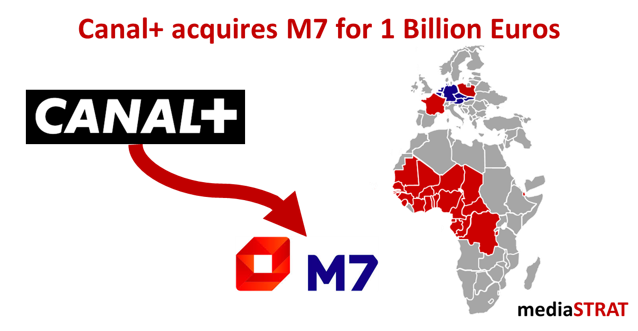

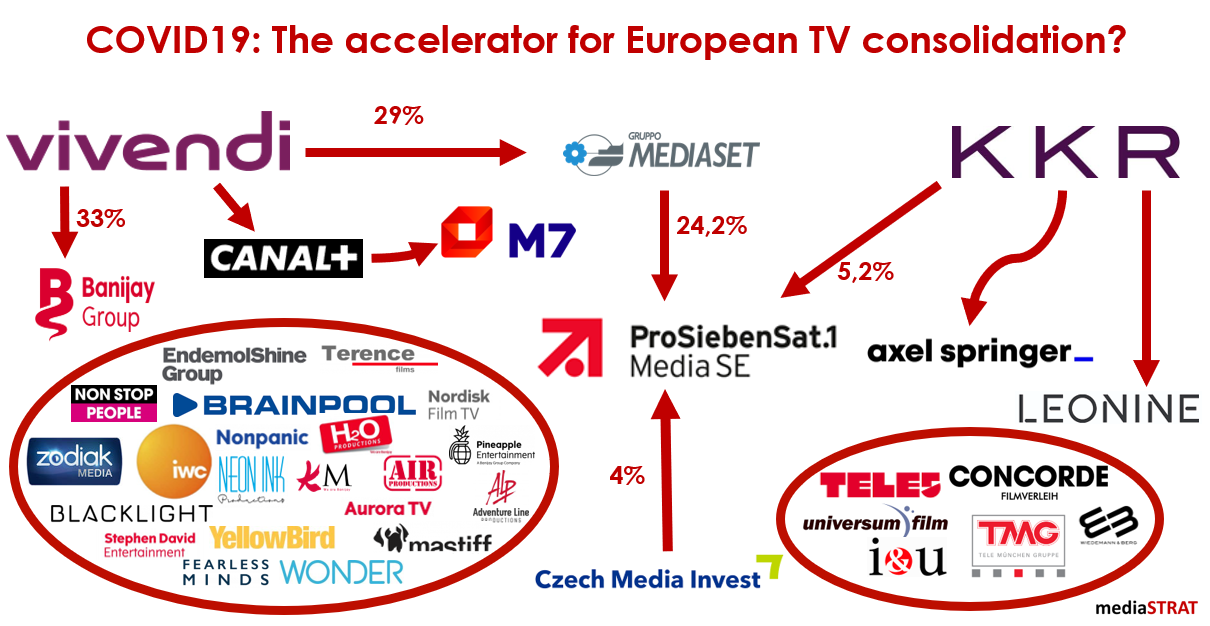

A vendor is looking for profitable sustainable growth and to maximise the return on investment of his sales team. Having globally known brands in one’s reference list gives a competitive leverage and differentiator when approaching other regional accounts. Despite the complexity of the engagement entering such global accounts offers access to larger projects. They can also help entering new markets by following their own expansion. With the market concentration resulting from M&As the ability to deal with such accounts is becoming a must if one does not want to get trapped in a regional niche attacked by more global vendors.

How to approach them?

Multinational customers expect to be treated as such and look for partners able to support them in a coordinated way wherever they are located. They are not willing to deal with the way vendor organisations are set up and expect them to adapt to their needs. They look for a coordinated governance, coherent pricing, volume discounts and want to deal seamlessly independently of the localisation of the projects.

Before starting a sales campaign the vendor should start with a due diligence. Every account is different. One needs a stake holder mapping and understanding on how decisions are made by whom and who is influencing them at local, regional and global level. Vendors need to understand the specific pain points, vision and requirements of the targeted prospects.

Vendors then need to define a sales plan and governance model involving the different parts of their sales organisations. By nature these are competing to reach their targets. With variable commissions to sales staff typically ranging from 30 to 50% of the on target earning (OTE) it can be fierce.

Best practice

It works best when the sales teams share and understand the goal, the methodology of the engagement as well as rewarded for his contribution. This can be achieved thanks to specific sales objectives, revenue allocation depending on the actual support of each part of the organisation or through KPIs.