Historically broadcast organisations have been predominantly regional. Local legislation including copyright and media chronology rules, the necessity to localise content in conjunction with traditional linear distribution method have maintained this status quo until recently. Even for the US based global media groups the domestic market represents an average of 80% of the total revenue.

Global media organizations regularly swing between centralised models to maximize efficiency through economies of scale and decentralised ones to facilitate localisation, tune programming for local viewership and maximise add sales. More importantly the global approach allows a better amortization for in-house produced content and gives more leverage for rights negotiations for third party productions. They have become hybrid: centralising whenever possible and localising whenever necessary.

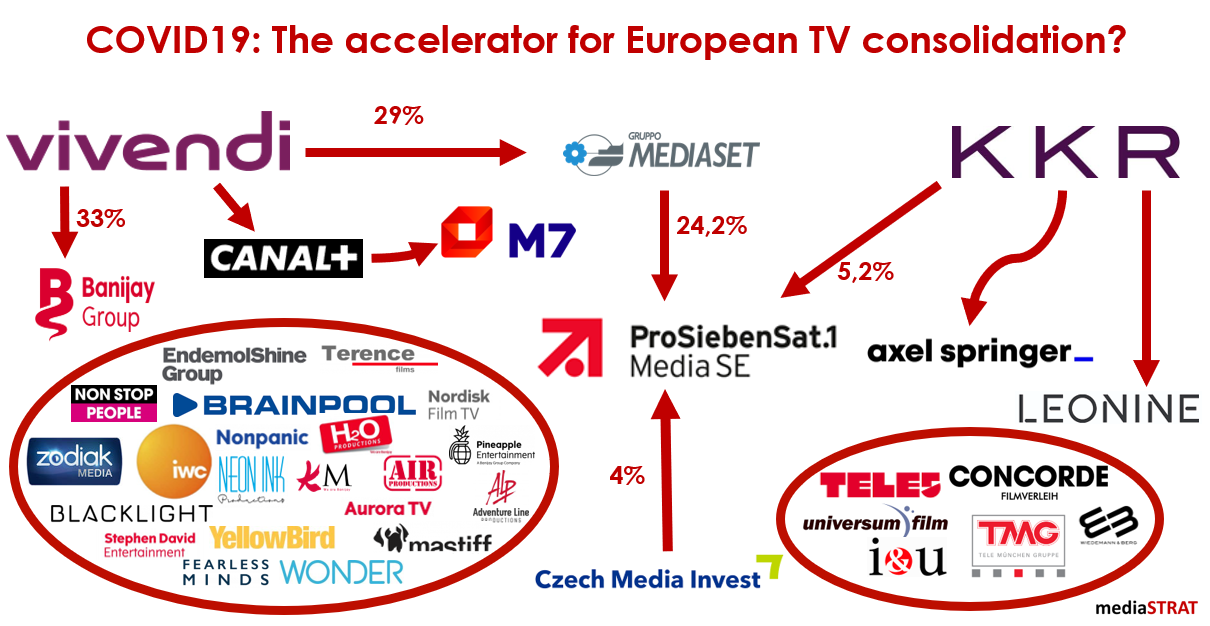

OTT distribution that technically eases global distribution changes the odds. As opposed to satellite, cable and terrestrial fixed cost distribution, OTT distribution costs grow linearly with the audience. On the one hand it lowers entry barriers allowing smaller media organisations to serve niche audiences globally thanks to low distribution costs. For larger players on the other hand it results in unpredictable distribution costs. Pay TV providers have correspondingly stopped combined offers providing OTT as free or low cost add on to classical premium bundles. The competitive pressure from new entrants has driven the appearance of skinny bundles cannibalizing premium offerings. This puts significant pressure on ARPU forcing the major players to accelerate their vertical integration and internationalisation, shut down less profitable channels or transform them from subscription to add funded free to air channels. It also puts a significant pressure on local media legislation as well as distribution agreements and changes the power base among the different players in the value chain between content production and viewers as new media distribution and aggregation companies emerge at high pace.

The resulting market fragmentation counterbalances the empowerment of the viewer who can choose between multiple offerings but struggles to actually find something he wants to see mechanically increasing churn rates. As media groups converge to become B2B2C organisations the need for personalisation as well as improved recommendation and user experience has become alongside with the fight for premium content their key priority.