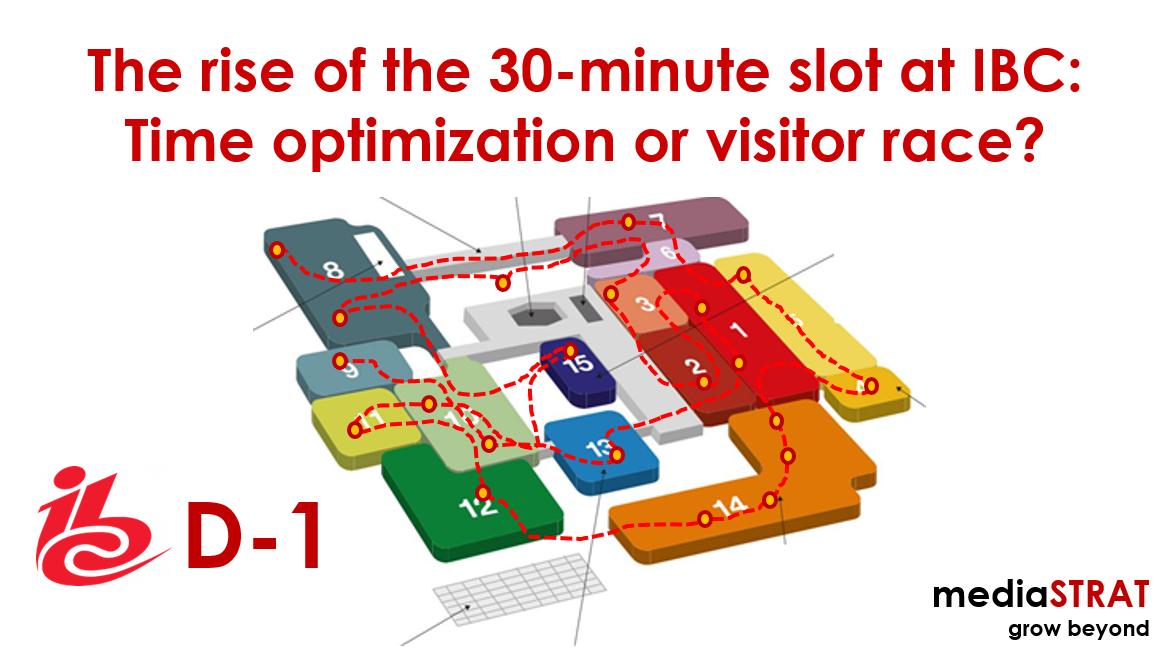

For those of you not familiar with the IBC trade show in Amsterdam many of the following references will sound cryptic. Every year over 55.000 broadcast media professionals from around the world gather in Amsterdam for a massive 5 days trade show with 1.700 exhibitors the International Broadcasting Convention (IBC). Since 2012 despite a continuous wave of M&As the floor space requirement growth has pushed the organizers to create an extra hall 14 in form of an oversized tent.

The hall hosts 180 mainly boutique companies providing solutions for the OTT domain from on line video platforms, monetization solutions, metadata, analytics, search & recommendation… Back in 2012 I (and most others) did not know how to spell OTT and VOD.

The change of the ingest workflow

For many years most, visitors were simply passing by the hall ignoring that an entire parallel eco system was emerging. Since the emergence of Netflix and Amazon that has shaken up the industry at its foundation was not enough to motivate visitors to cross the hall the organizers have located the only visitor registration point in the hall 14 forcing everyone to pass at least once. The fact that Google is now the very first booth one needs to walk by is by itself symbolic.

The tent is by nature a temporary construction in this case responding to a space problem, but I like the idea that it does say something about the way the industry is changing.

Cow Boys and Indians?

Since I live in Bavaria the first tent analogy that came to my mind was the upcoming Oktoberfest. But with the industry being largely Anglo-Saxon the Cowboy Indian feels more appropriate.

At high level the broadcast customers of the traditional tech vendors aka the Cowboys, the traditional multinational and regional media organizations are still doing well but suffer from an EBITDA erosion due to increased content costs, lowering linear subscription ARPUs, stagnating advertisement revenue and the necessary investment in OTT and VOD.

According to a recent study by the European Audiovisual Observatory the On demand pay revenues have grown 46% year over year but still only add up to 3% of the total EU audiovisual market as compared to 31% for pay TV and 28% for add funded TV.

Hall 14 sitting in front of the other halls is full of agile Indians attacking the Fort.

Like in Highlander Hall 1 or Hall 14 “There can only be one”

Whereas in the more traditional segments like production, post production, automation or management systems a few vendors dominate the market with a few smaller often regional competitors the OTT space due to its significantly lower entry barriers is made up of dozens of vendors.

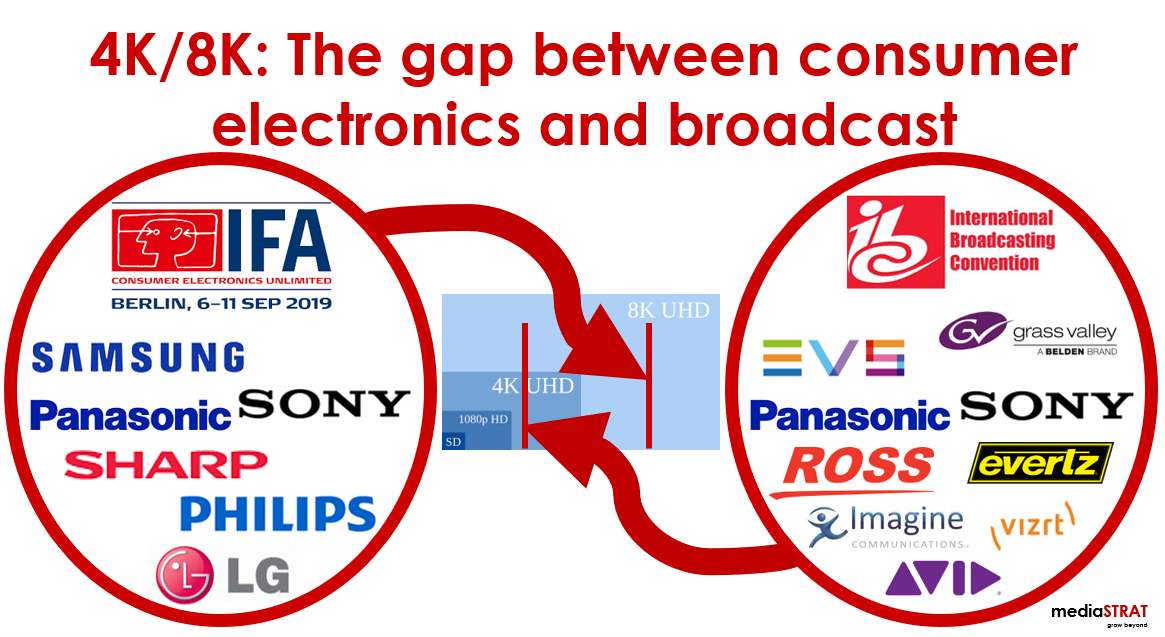

Hall 1 hosts the telecom and satellite media distribution eco system. There is no question that linear will remain the most popular media consumption mechanism for a long time even if at least in the bandwidth rich regions the OTT distribution will progressively overtake its distribution. The 46% year over year S-VOD growth the Europe in an overall rather flat media market pushes the hall 1 vendors under the pressure of their customers to develop OTT offerings often by buying hall 14 type companies. At the same time some OTT pure vendors are making their way into the hall 1 and grow their floor space.

As the market will mature and consolidation take place the two halls will eventually merge and the tent either disappear or fills with the next wave of disrupters.

Who from the Indians or the Cowboys will win?

It depends on the future landscape of the media industry and the pace of change. Services like Netflix and Amazon representing 75% of the total media revenue in Europe as well as Disney’s future service and some larger joint ventures are essentially insourced or at least partially building on their own tech stacks. The recent spin off of both Cisco’s and Ericsson’s media businesses despite billions of investments seem to demonstrate that there are simply not enough very large-scale projects to create the expected value and growth.

As the OTT market matures, provided that aggregators with appropriate search and recommendation tools emerge, some more niche services with a global reach should develop.