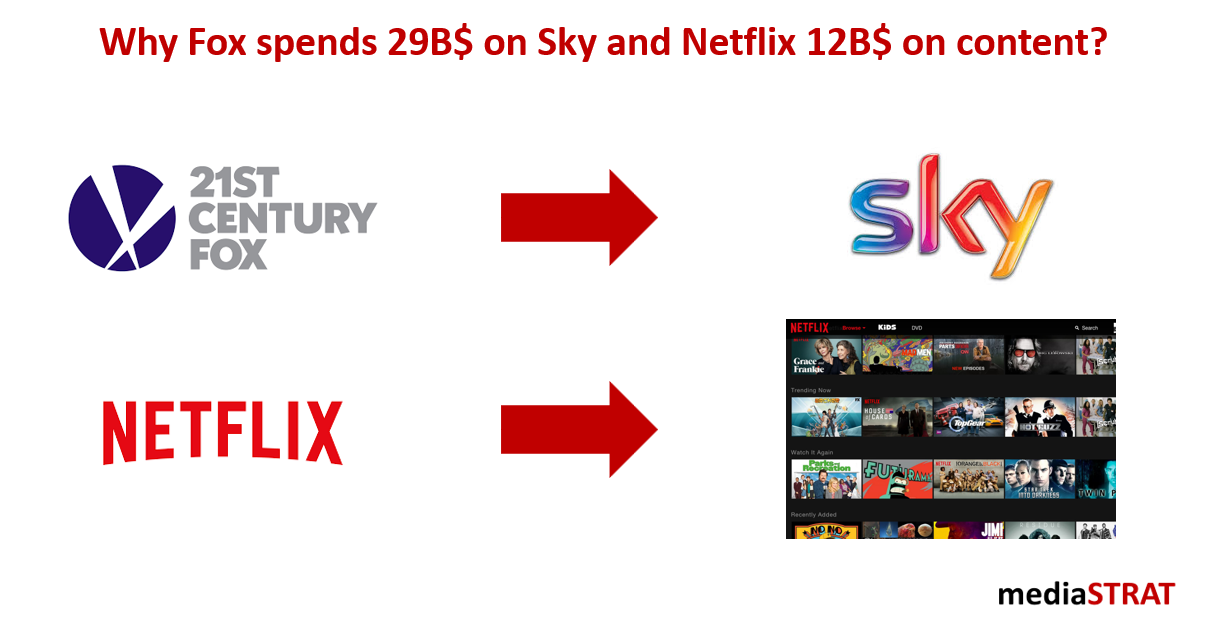

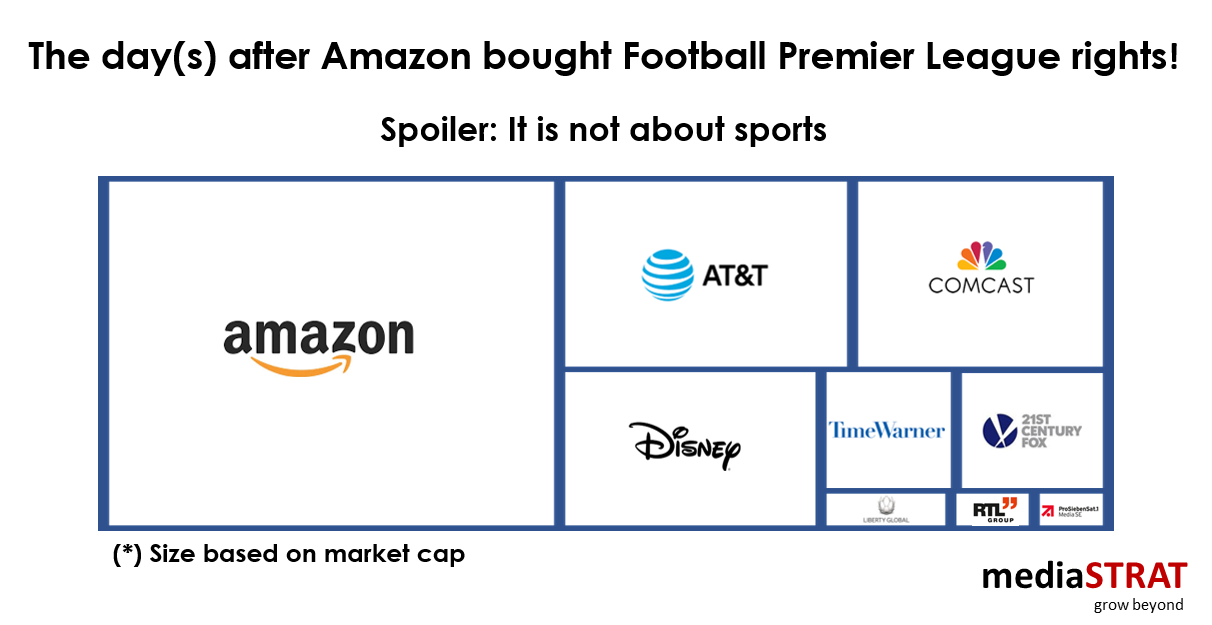

According to the Economist Netflix is planning to spend over 12B$ on content while Murdoch’s 21st Century Fox has just increased its bid to 29B$ on the remaining 61% of Sky it still does not own. Even if from a viewer’s perspective both groups provide paid entertainment these parallel announcements depict different strategies and positioning in the media food chain.

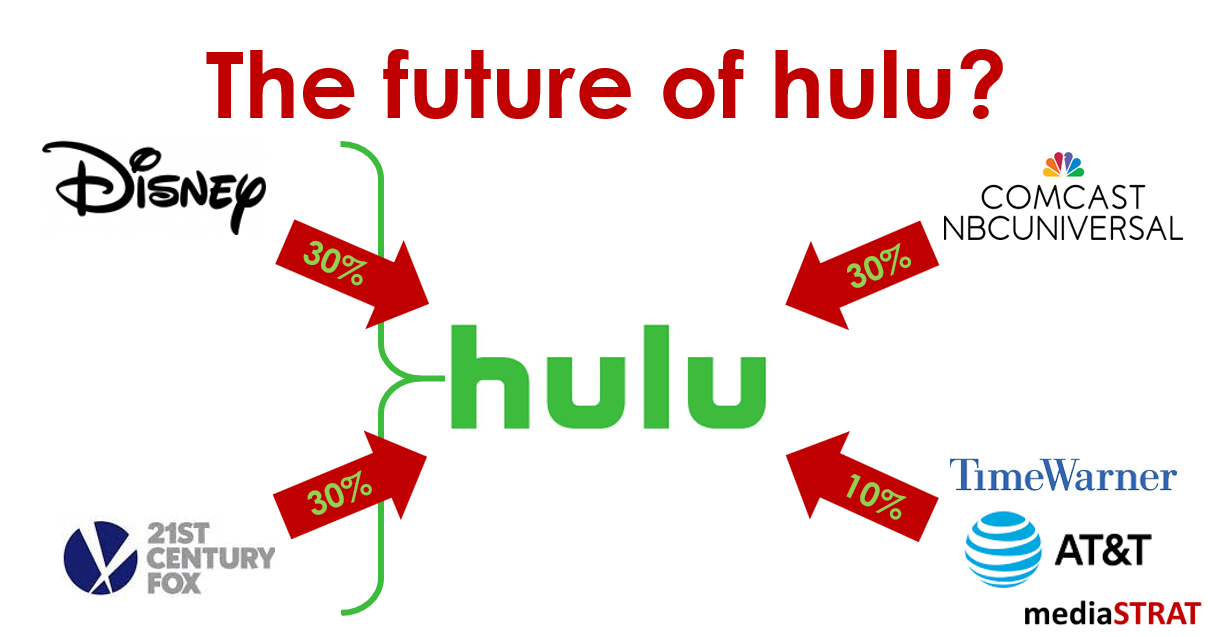

The future of Hulu?

I do not know if “Prediction is very difficult, especially about the future” is indeed a quote from Denmark but it applies well to the transformation of the media industry. This should not prevent us to apply predictive analytics to the future of Hulu. From my experience dealing with the legal departments of the Hollywood studios the outcome of a change of control is likely to be already cast in the stone of the contracts but who knows?

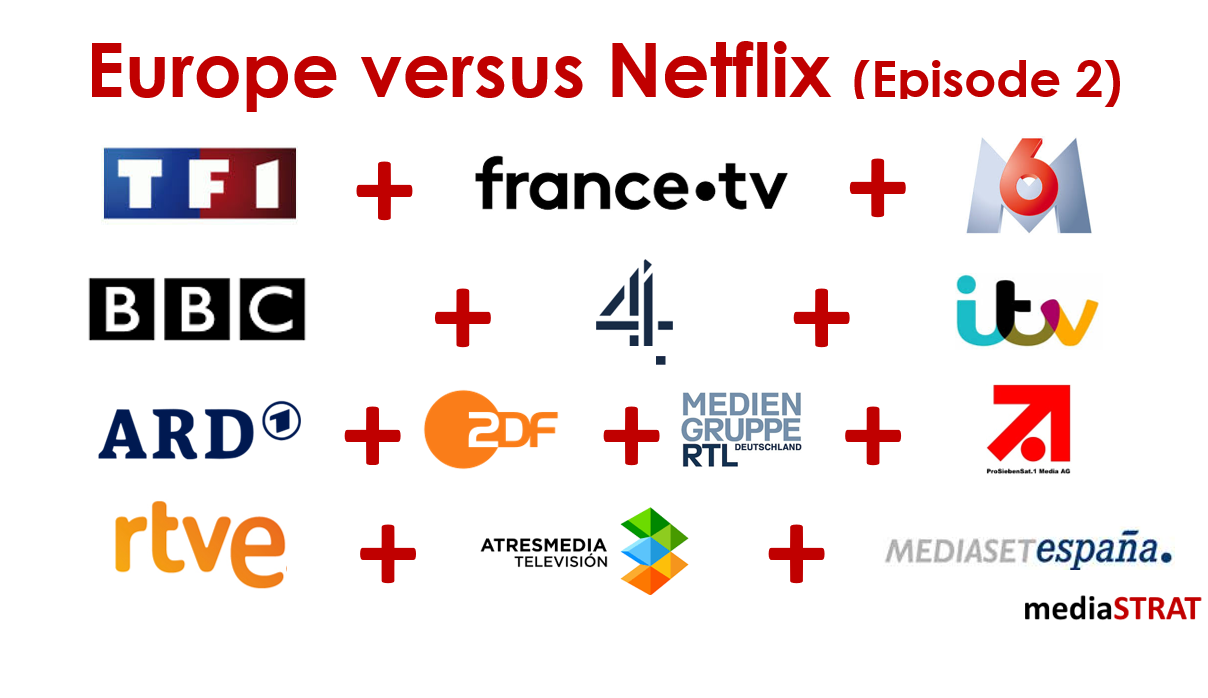

Europe versus Netflix (Episode 2)

Before diving into the topic, I would like to thank you for the views, likes and more importantly all the conversations that followed. This week the announcement of the unified VOD platform of ProSiebenSat.1 and Discovery the most international of the US media groups confirms the emergence of the new cooperation driven media landscape.

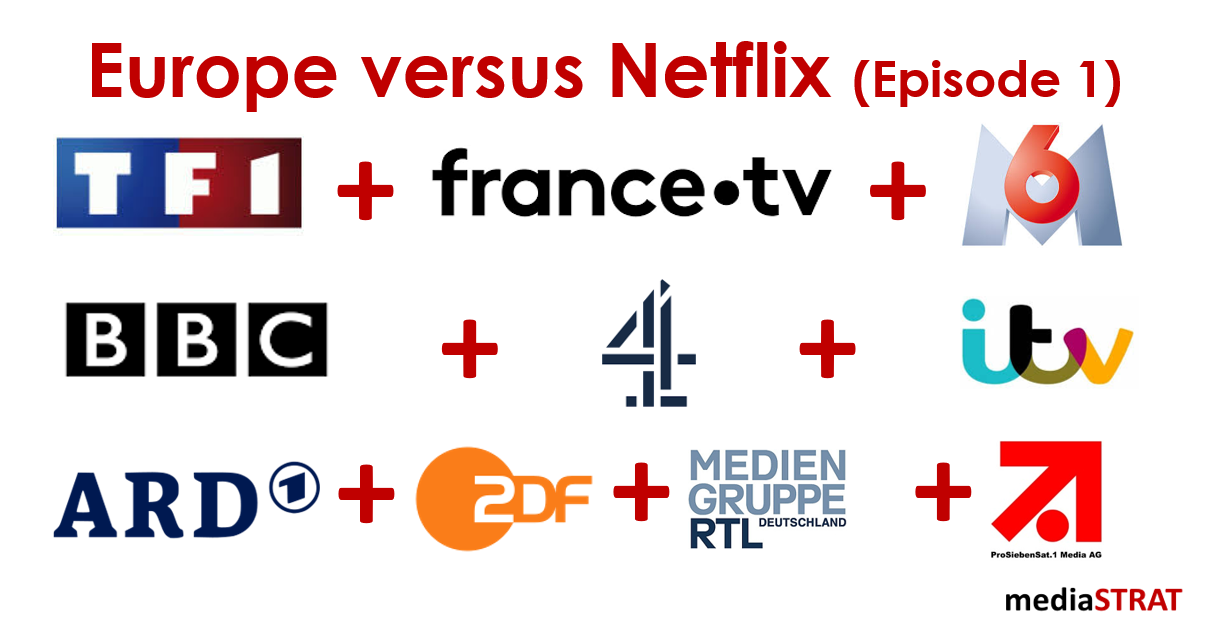

Europe versus Netflix? (Episode 1)

Europe wants to fight back

Over the past few weeks throughout Europe initiatives have been started and cooperation announcements made. It finally seems that many Europe media companies are now trying to join forces to fight the Netflix’s of the world. Those of you who had a look at my previous articles on the respective size of media companies can certainly relate to that.

The day(s) after Amazon bought Football Premier League rights!

Spoiler: It is not about sports

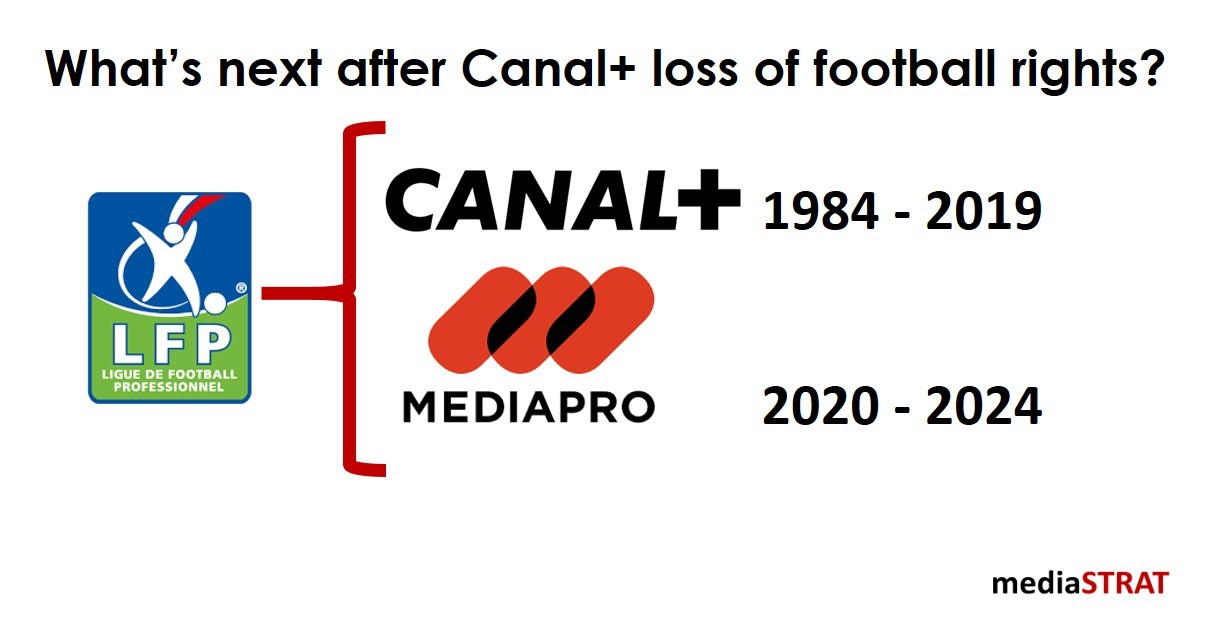

“What’s next after Canal+ loss of football rights?”

I concluded my June 1th post by writing: There is no question that Amazon has the platform, the subscriber base and the marketing dollars to become the absolute champion in the Sports arena but will they want it (or when). Less then a week later we have the answer!

What’s next after Canal+ loss of football rights?

Even if the skyrocketing inflation of sports rights has been going on for years, the fact that mediapro has been awarded the ones of the French 1st football league is a new milestone in the tectonic changes within the media industry.

Canal+ Siberian dilemma

Canal+ was facing what I call a Siberian dilemma: When you fall into water in Siberia you either decide to stay in the water and die in a few minutes or get out and die instantly. In Canal+ terms: bid high and burn cash due to the difficulty to recruit (or regain) enough subscribers or bid low with the risk of a massive churn. Over the years in France Canal+ even if they were able to stop the trend recently is progressively losing subscribers as they lose more and more sport rights to beIN, SFR and co.

Tech investments in the TV4.0 era

Every other year the FKTG conference provides a unique insight into the state of the media industry. This year edition between June 4th and 6th in Nurnberg will be focusing on the different aspects of the end to end IP transformation.

mediaSTRAT is proud to have been selected to present a paper on a hot topic.

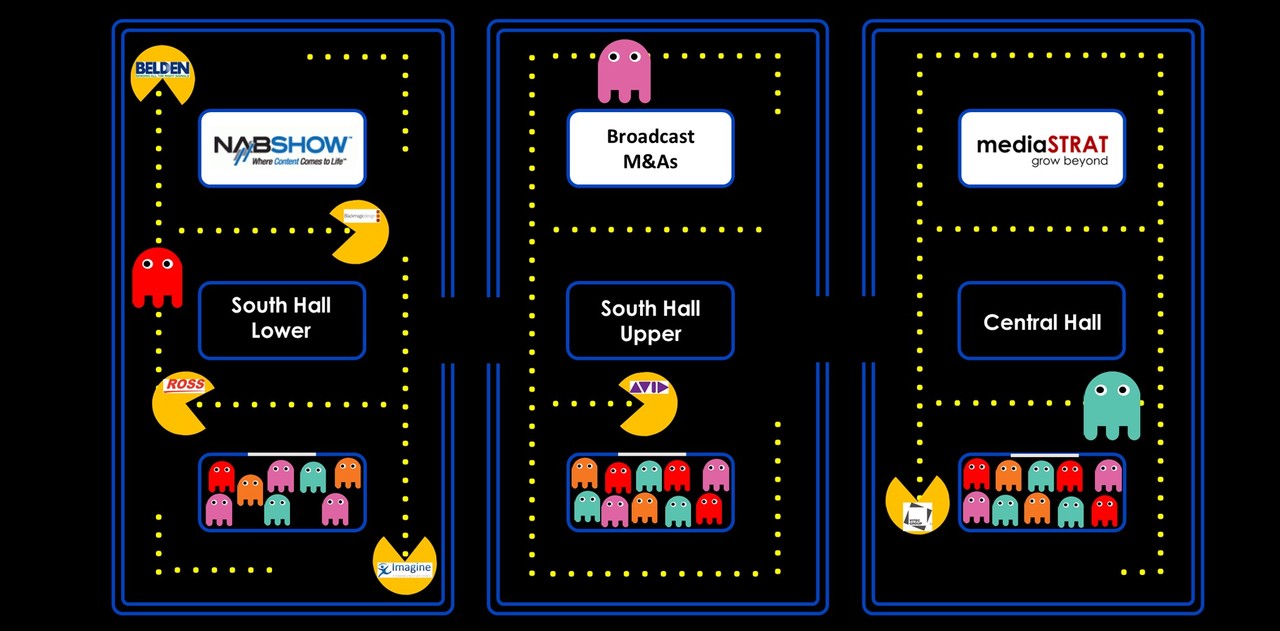

1+1>2: How to create value after broadcast vendor M&As

The NAB show period is favourable for merger announcements and rumours. This year is no different with the confirmation of Belden / Grass Valley acquiring S.A.M. Recent analysis from MediaBridge Capital Analyis and Devoncroft track the rational and the dollars behind M&A’s.

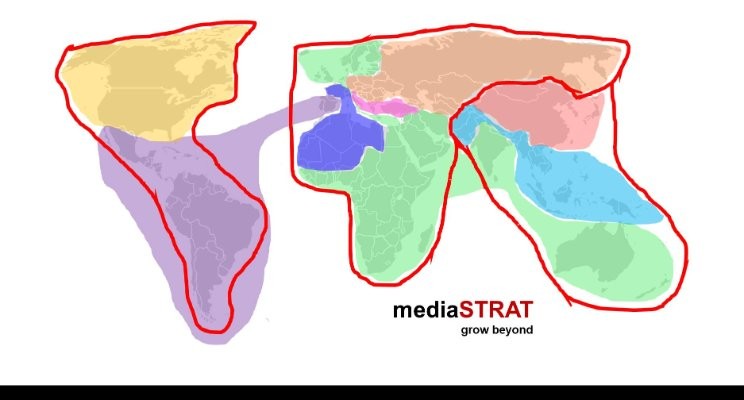

Engaging with multinational key accounts: a B2B sales challenge

Different go to market strategies

There are multiple ways to organise an international sales force: By region, by product line, by go to market strategies (direct versus indirect or OEM), separating hunters & farmers, by nature of the customers/type of usage… They drive the efficiency, localisation, reactivity and economies of scale of sales teams. All these models have pros and cons and vendors tend to navigate between them over time. The centre of gravity of the sales organisation also varies depending on where does one set the cursor between centralise whenever possible and localise whenever necessary versus highly decentralised approaches.

Meta search: Who will help you find the content you want to watch?

The broadcast media industry is experiencing two antagonistic evolutions: On the one hand a concentration in large eco systems with players like Amazon, Apple, Disney, Comcast or ATT but on the other hand a strong fragmentation with dozens of available video services in each country.